Wedding Budget Mistakes to Avoid

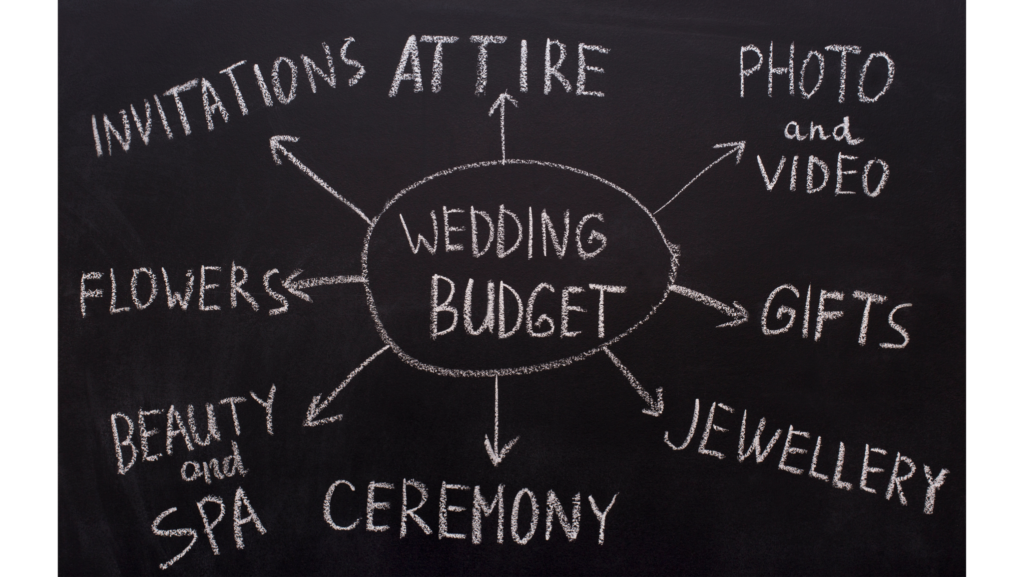

In our last issue, issue 29, we showed you a breakdown of the average percentage a couple may spend on the different elements of their wedding day. It is a great guide when figuring out the budget for your wedding. The breakdown is not intended to be used literally but more as a guide to help you start planning your budget. With the information from our wedding budget breakdown article, you are on your way to creating your expense list for your wedding. To help you a little more, we have a list of the most common wedding budget mistakes couples have made, which means we can help you avoid making those same mistakes.

1. Not allocating funds correctly. Figure out what you want for your wedding and how much you need to spend to obtain what you want. Set your expectations accordingly and reference the guide from our last issue. Remember to budget for your honeymoon, especially if you are paying for it yourself. To help with that, you can set up a honeymoon fund for your guests to help contribute. They may be happy to gift you funds so you have a fantastic honeymoon.

2. Not keeping track of your spending. Make a list of everything you will spend money on for your wedding. As you make payments, record them because keeping everything organized is critical. Check in often with your fiancé and anyone else who may be contributing to your wedding. You need to stay on the same page and stay on track.

3. Forgetting to budget for hidden costs and extras. It’s nearly impossible to budget for every little expense that might arise. Build a buffer for those unforeseen hidden costs to have flexibility later. Do some research and talk with your vendors to find out ahead of time what some of the extras may be. A few common extras to consider are overtime, service fees, “free” trials, extra decorations or miscellaneous items, gratuities, and vendor tips.

4. Not discussing priorities from the start. Be honest and upfront about what is most important. Pick the top three most essential elements and list the least important. Priorities must stay in check to avoid starting your marriage with too much debt.

5. Not investing in insurance. By now, we have learned a lot from the Covid pandemic and how quickly things can change. That said, purchasing special event insurance is a good investment. If you have to cancel or postpone the wedding, insurance can help with deposits and non-refundable payments.

6. Not being tough on the guest list or having too many people in your wedding party. Cutting back on the guest list will bring costs down, and the same goes for the number of people in your wedding party. Gifts or other items for the wedding party are cheaper for three people than for eight people.

7. Not being realistic. Don’t oversimplify the financial aspects of your wedding day. Make sure you know realistically what the cost of each element will be. It’s the best way to stay on top of your budget.

There are a lot of parts to planning a wedding. Setting your budget and being prepared will reduce your and your partner’s stress levels. This is your big day; make sure you can make it what you want.